OlympusDAO: Explained

Let's dive into one of the most exciting projects in crypto. Here's OlympusDAO 101.

Note: I’m long a small amount of $OHM. This piece is intended to be purely informational and not an investment recommendation at all. Please do your own research!

If you’re into crypto, you’ve surely heard of OlympusDAO, one of the most ambitious and exciting projects in all of DeFi. If you’re not into crypto or have never heard of Olympus, hopefully this post helps you understand what’s going on and why it’s such an interesting project.

A word of warning - this post is going to be a little longer and a little more complicated than most. I’m going to do my best to keep things relatable, but at times it may take a little bit of extra thought to understand. If you have any questions about anything I said, feel free to email me or leave a comment under the article.

What is Olympus? From Olympus’s docs:

Olympus is a decentralized reserve currency protocol based on the OHM token.

Don’t worry, I know that sounds intimidating. We’re going to go through each part of OlympusDAO step by step. For a quick primer on reserve currencies, check out this Investopedia article.

The Problem

Let’s start with the problem. What is OlympusDAO trying to solve?

Part of the crypto ethos is being independent from existing financial institutions; we love to decentralize and make products permissionless. A key element of the Bitcoin thesis is that it’s totally independent of any individual, group, or sovereign power. No one can print more bitcoins, so there will never be more than 21 million bitcoins in circulation.

At the same time, though, crypto relies heavily on stablecoins (the market cap of stablecoins today is $131 billion), tokens that are pegged to the US Dollar. People rely on stablecoins to mitigate the volatility that’s widespread in crypto. The prices of bitcoin and ETH can fluctuate wildly, and you may not want to have exposure to such volatile assets.

Stablecoins (USDC, USDT, and DAI, to name a few) are managed either by centralized companies (Coinbase manages USDC) or by DAOs (MakerDAO manages DAI). When you go buy 1 USDC from Coinbase, they’ll take your US Dollar and hold it as value that “backs” your USDC. Because each USDC is backed by 1 USD, you can be sure that there’s real value backing your token.

In the end, stablecoins are still pegged to a government-controlled asset, the US Dollar. Depending on your beliefs about inflation and monetary policy, that may or may not be a good thing. Central bankers may or may not have your best interests in mind; when they do print money, it tends to most benefit the rich, those who already own assets like stocks and bonds. As money flows into the market, it drives asset prices up, increasing the wealth of asset owners. Also, there’s the Cantillon effect - when money is printed, it’s not distributed evenly. Historically, it’s been the financial institutions and wealthy who have reaped most of the benefits. But what if the Fed was perfectly aligned with everyone who held the currency? OlympusDAO seeks to create this alignment by discussing its monetary policy out in the open and designing tokenomics with the token holders in mind.

Because of inflation, holding stablecoins as a store of value is not a good idea. You’ll lose more and more money over time as the Fed prints more money, causing your money to become worth less and less.

It’s also in the interests of the crypto community to create their own currency that’s independent of any government or centralized entity. As we transition to web3 and crypto becomes more mainstream, stablecoins pegged to the US Dollar are useful. But in order for crypto to truly be independent, it’ll need to form a new reserve currency that’s not reliant on the Federal Reserve or the government’s monetary policy. We need a currency for the people, by the people.

OlympusDAO

Olympus wants to solve this issue by creating a decentralized and free-floating currency. Olympus is not seeking to create another stablecoin based on the US Dollar. Instead, they’re attempting to create a currency that maintains its purchasing power.

To accomplish this rather ambitious goal, Olympus makes use of a the OHM token (its currency), a Treasury of DeFi assets, and bonding and staking mechanisms. Each piece of the protocol works in harmony with the others to drive token value and adoption.

Risk Free Value & OlympusDAO’s Treasury

Way back in the day, the US Dollar was actually backed by gold. Our money was directly linked to the gold held by the US Treasury. In 1971, President Richard Nixon decided to break the gold standard, meaning that the government would no longer convert dollars to gold at a fixed value. Today, our money is backed by US Treasury and Federal Agency bonds. One could also argue that the dollar is backed by the United States’ status as a world leader, trading partner, and military giant. People believe that the dollar has value because everyone else does, not because you can go to the government and request gold in exchange for your dollars.

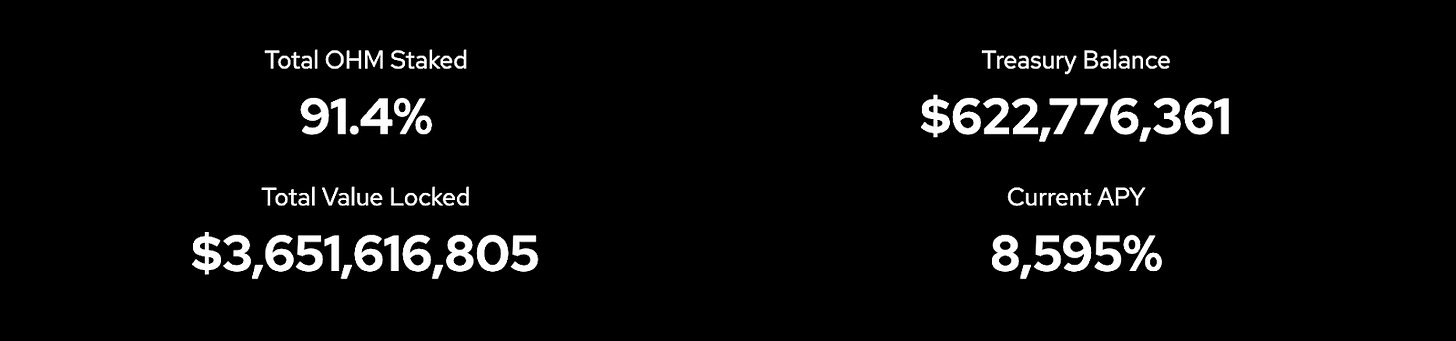

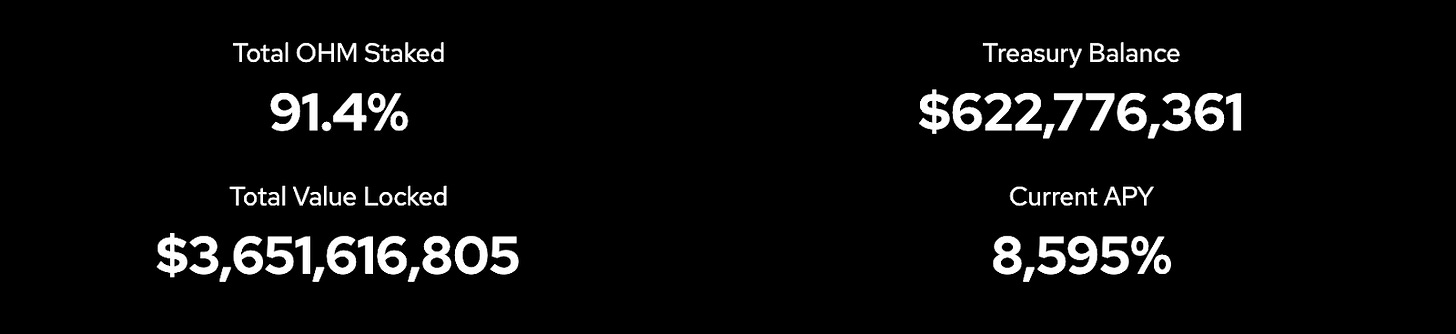

Just like the Federal Reserve once held gold, OlympusDAO holds a Treasury full of assets - decentralized, crypto assets. Today, this Treasury is worth over $600 million.

This Treasury balance is what underpins the value of the OHM currency.

Because the Treasury has a value backing the currency, there should be a floor price on the OHM token. In other words, because it owns a bunch of stablecoins (and other assets which we’ll get to), there’s a theoretical minimum price for the OHM token. If OHM were to drop below that value, you’d be able to buy a claim on the Treasury assets for less than what they’re worth.

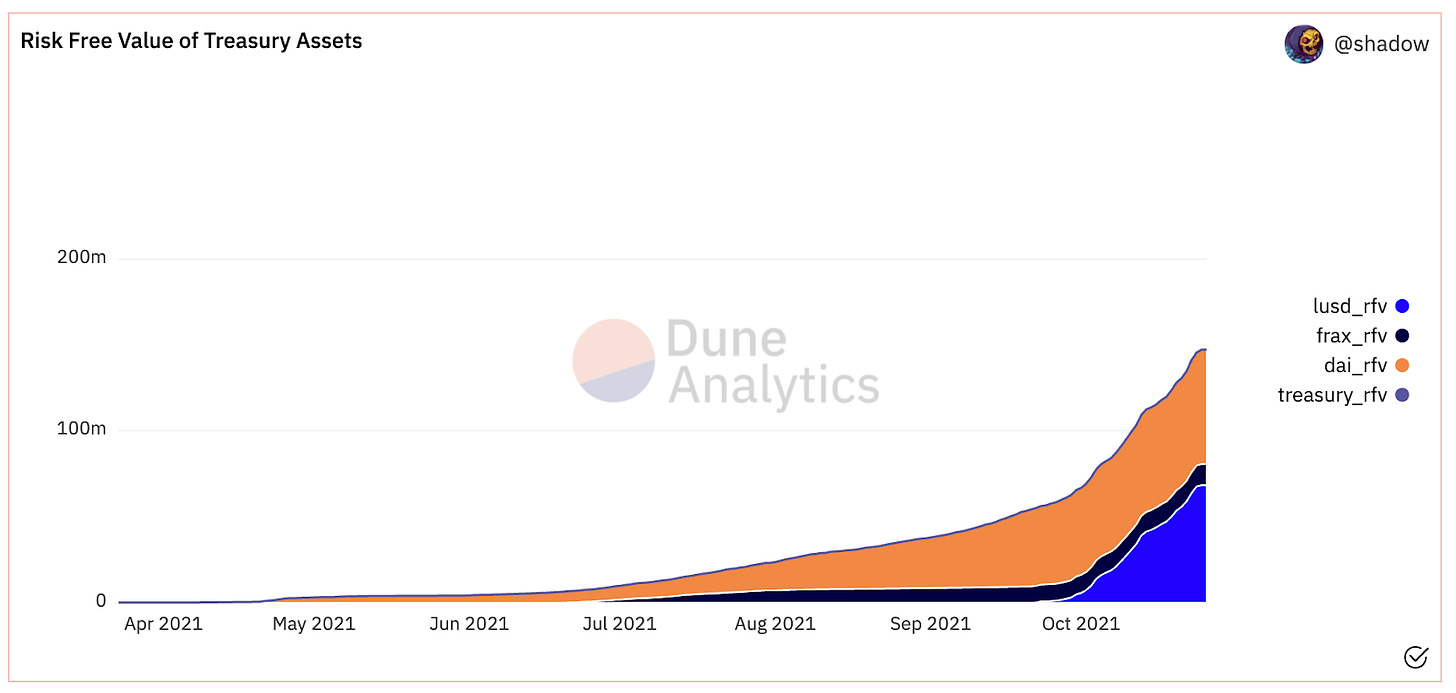

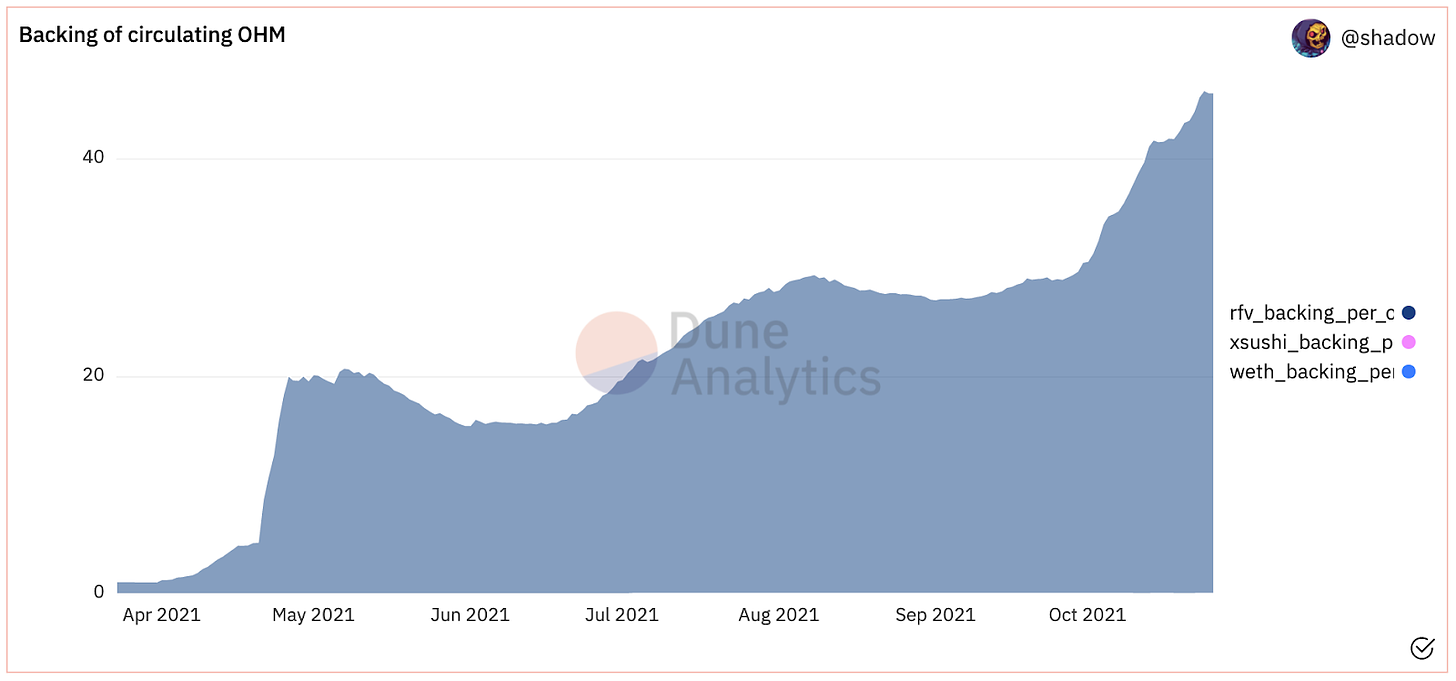

We can think of this floor price as the Risk Free Value (RFV). The RFV of OHM today stands at around $150 million; this RFV figure is based on OlympusDAO’s stablecoin holdings and Liquidity Provider (LP) tokens (valued at a discount since their value can fluctuate).

Today, OHM trades at a premium to its RFV; that means people have some expectations of future growth, want to stake their OHM to earn yield, or have other reasons for owning OHM other than as a claim on the RFV.

OHM trades around 47x over its RFV today. Remember this for later!

OlympusDAO has rules around minting and buying back OHM; they can’t just issue unlimited OHM. Instead, it must be backed by RFV. More specifically:

1 OHM must have at least 1 USD in RFV behind it (that means that today, Olympus could increase their supply of OHM tokens by 46x).

When OHM > 1 USD, the protocol will mint OHM and sell it to increase Treasury assets.

When OHM < 1 USD, the protocol will buy back OHM using Treasury assets and then burn the OHM, driving the price back up.

Today, OHM is trading at over $1,100. Shouldn’t it be trading at $1? Why doesn’t Olympus mint more OHM in order to increase its Treasury and drive the price closer down to the RVF? Olympus is actually agnostic to the price of OHM right now as long as it’s above $1. In fact, they’ll make more profit selling OHM the higher the price gets (as we’ll see with their bonding mechanism). Remember, OHM is backed, not pegged; it has no obligation to follow the US Dollar as other stablecoins do.

Also, in its early stage, Olympus is optimizing for 1) supply growth of the OHM token and 2) growth of its Treasury. In order to facilitate proper currency transactions, Olympus needs its supply of tokens to grow. Today there are just 3 million OHM in circulating supply; as a mature currency, there will need to be billions or tens of billions of OHM. Second, in order to create tens of billions of OHM, OlympusDAO also needs tens of billions in value in its Treasury (in order to back the currency). As Olympus becomes more mature, it can shift its focus to ensuring the stability of the token.

One final point on the Treasury: with such a significant market value, Olympus is accumulating a lot of yield-generating power. By yield-generating power, I mean that Olympus could take their stablecoins and lend them out on a platform like Aave, earning some additional yield that could then be passed on to stakers in the form of staking rewards.

Now that we’ve established that each OHM has an intrinsic value of at least 1 USD (based on the RFV), let’s explore how Olympus executes on its goals. There are two key mechanisms to explore: staking and bonding.

Staking

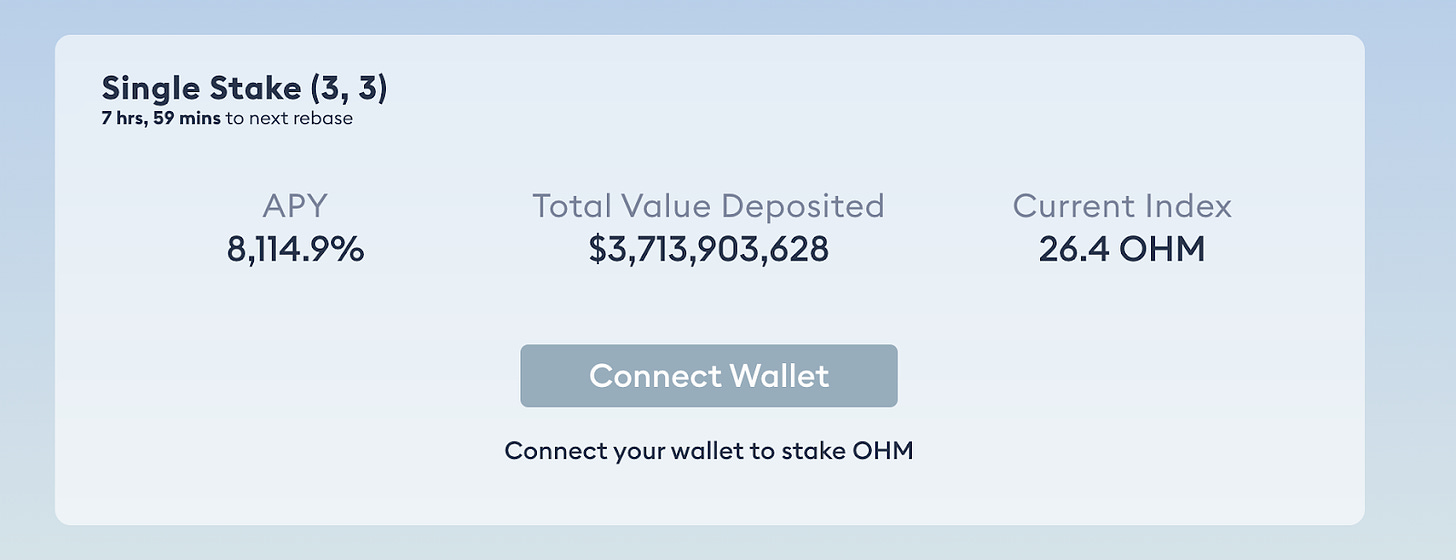

Staking is where the magic happens. Around 90% of OHM in circulation is staked today. As Olympus notes in its docs, “Staking is the primary value accrual strategy of Olympus.” OHM holders take their OHM and stake it on the Olympus website to earn rewards. These rewards are proceeds from bond sales. The level of rewards earned for staking OHM depends on the number of OHM that’s staked in the protocol as well as the reward rate that’s determined by the DAO’s monetary policy.

When you stake your OHM, you receive another token in exchange: sOHM. sOHM represents OHM that’s staked and eligible for rewards. As you earn rewards, your sOHM balance automatically increases. Just like other ERC-20 tokens, sOHM is transferable and composable. As I noted in my article about ERC-20 tokens, this makes it another DeFi Lego that we can build off, leading to all sorts of exciting possibilities.

As you stake, you earn more and more sOHM. Right now, the staking rewards are at a whopping 8,595% APY! Your sOHM is automatically compounded every 8 hours.

How is Olympus able to sustain such a high APY for its stakers?

Remember above how I mentioned that the value of OHM is 47x its RFV? Olympus is able to use this spread in order to mint more OHM and distribute it to stakers. Each OHM needs just $1 to back it; for each OHM in existence today, it could mint 46 more before hitting the RFV. As Olympus grows, it’s taking advantage of this premium to mint and distribute OHM to its stakers. And as the Treasury continues to grow (via bond sales), Olympus will have an even greater ability to reward its stakers.

As Olympus notes, staking is a long term, passive strategy. As you stake your OHM and earn more and more OHM as rewards, your cost basis falls as well. If you hold over a long enough time frame, your rewards will outweigh any fall in the price of the OHM token and you’ll still earn a profit.

One important dynamic to take note of is that wealth creation in Olympus takes place through token accumulation rather than price accumulation. In other words, you make more money on your investment by earning more tokens, not by the token price increasing.

Check out this video from Olympus showing how to buy and stake OHM:

Bonding

Bonding is the second tool in OlympusDAO’s toolkit.

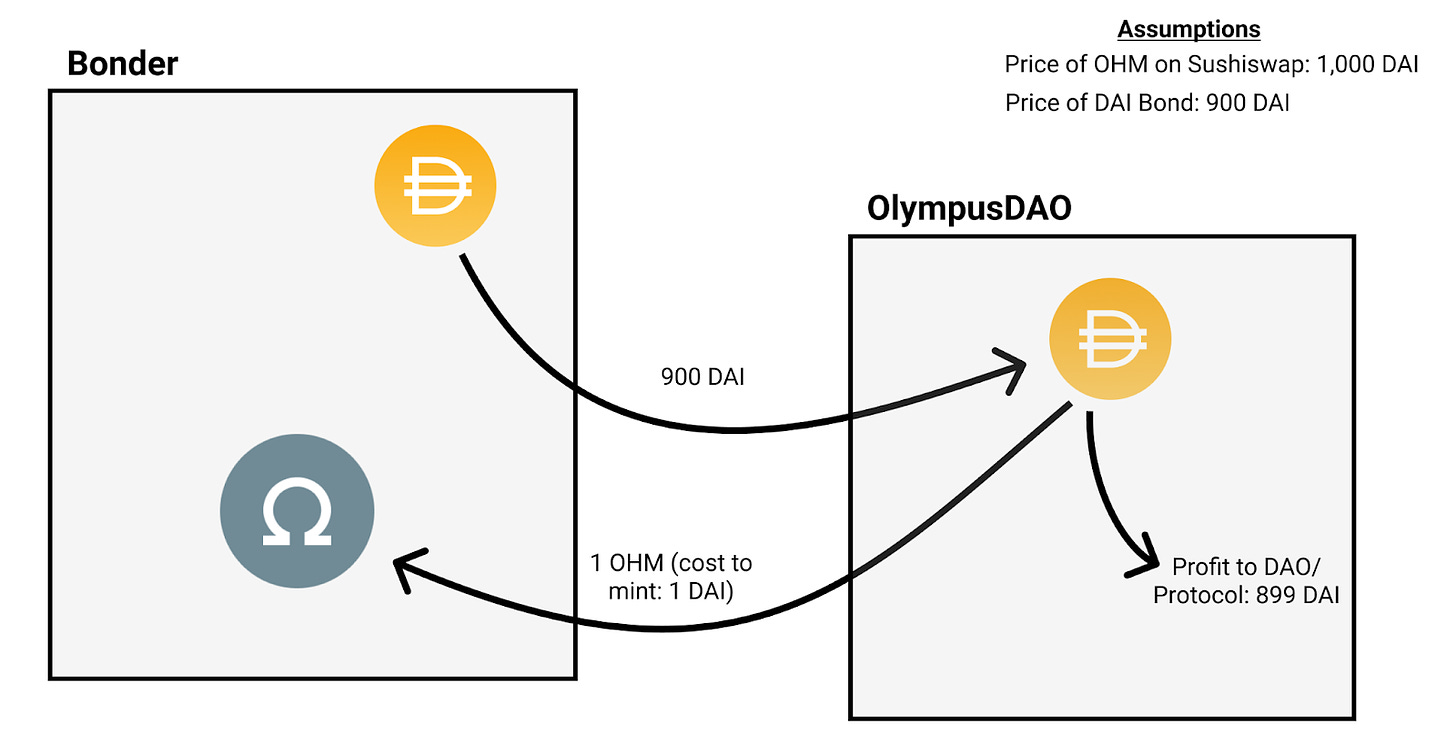

As a user, you can sell assets to Olympus and in turn receive OHM at a discount. Because the intrinsic value of each OHM is just 1 USD (the required RFV), Olympus is able to make a profit on the spread. Here’s a (slightly simplified) example:

Suppose that 1 OHM is trading for 1,000 DAI (= $1,000) and that OlympusDAO is offering a 10% discount to people who buy a DAI bond. Olympus will take the 900 DAI, mint 1 OHM (for a cost of 1 DAI, the floor value of the OHM), and receive a profit of 899 DAI. This 899 DAI will then be split between the stakers and the DAO. Stakers will receive 90% of the 899 DAI while the remaining DAI will be used to create OHM to fund the DAO’s operations.

Bonding elegantly accomplishes a number of objectives.

First, bonding is a way for Olympus to grow its treasury. Olympus takes the bonder’s assets into their Treasury and provides OHM to the bonder over a vesting period. Once the vesting period is over, the bonder can claim the full amount of OHM tokens.

Second, bonding allows OlympusDAO to accumulate and control its own liquidity. As rational market participants, we’d like to get the lowest price for the OHM that we’re buying. Because of the spread that I mentioned above, Olympus is able to offer a discounted price on OHM while still earning a significant profit. This is a win-win for the user and the protocol. The user wins because they get a better price than they would get on an exchange like Sushiswap. The protocol wins because they’re then able to control their liquidity (more on this in the next section).

Bonding is not “set it and forget it.” Prices fluctuate with market demand and aren’t readily predictable. Bond prices are high when there are many bonds outstanding and low when there are fewer bonds outstanding. So it’s not as predictable and passive as staking income is.

As of today, you’re able to buy OHM with 6 different assets. 4 of them are simple ERC-20 tokens:

DAI

FRAX

wETH

LUSD

You’re also able to buy a bond with something called a LP token, which represents your deposit in a decentralized exchange like Sushiswap. You can use OHM-DAI LP, OHM-FRAX LP, or OHM-LUSD LP tokens.

Here’s a video from Olympus on how to buy a bond:

Protocol Owned Liquidity (POL)

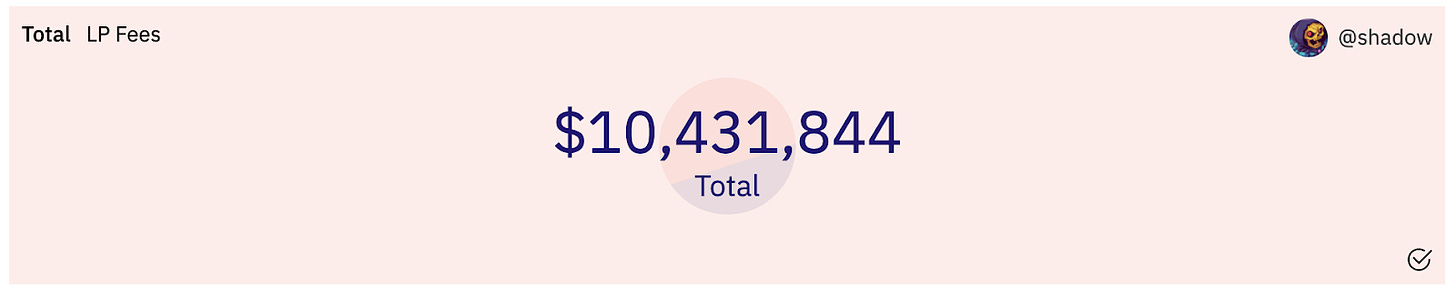

Importantly, bonding allows Olympus to control its token’s liquidity. Because they control the token’s liquidity, they can ensure that liquidity is always available and can earn the trading fees associated with providing liquidity, adding another revenue stream to its arsenal.

Since inception, Olympus has earned over $10 million in trading fees.

Owning its tokens liquidity allows Olympus to avoid the problematic practice of liquidity mining, in which a protocol pays token holders to provide liquidity on exchanges like Uniswap and Sushiswap. While it works for a period of time, liquidity mining is a double edged sword. As soon as rewards dry up, liquidity providers tend to take their capital and move to the next juicy trade. With POL, Olympus can avoid all that and actually make a profit of its liquidity.

What’s really interesting about controlling the liquidity pools for OHM is that Olympus has earned liquidity mining incentives in the form of CRV and Sushi, giving them metagovernance power. As they accrue more and more governance tokens, they’ll become an increasingly important voice in governance decisions and can vote in ways that will favor OlympusDAO and OHM holders. A similar dynamic will play out as Olympus starts accepting more types of tokens in their bonding process. If Olympus is successful, it’ll become a DAO governance juggernaut.

OHMies and (3,3)

If you’re on crypto Twitter you’ve probably seen people whose Twitter names end in (3,3). Congrats - you’ve found an OHMie!

OlympusDAO’s community members and supporters - known as OHMies - are some of the most passionate and vocal people on crypto Twitter. With a strong community, Olympus has been able to grow super quickly.

The (3,3) notation refers to a piece of game theory relating to different actions that can be taken in the protocol. You can either stake, bond, or sell.

Staking and bonding are beneficial to the protocol. Staking puts positive pressure on OHM’s price (because you need to buy OHM in order to stake it). Conversely, selling puts negative pressure on OHM’s price.

The matrix below shows how different actions taken by two people can impact the protocol. The most beneficial pair of actions is when both parties stake OHM (3,3). From the Olympus docs:

Staking (+2)

Bonding (+1)

Selling (-2)

If both actions are beneficial, the actor who moves price also gets half of the benefit (+1). If both actions are contradictory, the bad actor who moves price gets half of the benefit (+1), while the good actor who moves price gets half of the downside (-1). If both actions are detrimental, which implies both actors are selling, they both get half of the downside (-1).

This part isn’t all that important to understand, but hopefully you’ll at least have some idea of what those (3,3) characters on Twitter are all about.

Summary

OlympusDAO is taking on an incredibly ambitious project in trying to create a crypto-native reserve currency. Its elegant staking and bonding mechanisms have worked very well so far and have allowed Olympus to take control of its token’s liquidity. Time will tell if Olympus is able to realize its lofty dreams, but it’ll be a wild financial experiment no matter what.