NFTs are kind of bizarre. Even the name, non-fungible token, sounds confusing. NFTs had a big boom earlier in 2021 and have cooled off a little bit, but there's still a lot of exciting stuff happening in that space.

Let's start by breaking down the name.

(Note: NFTs can live on chains other than Ethereum, but I'm going to be focused on Ethereum for this post).

Non-Fungibility

From Investopedia, here's the definition of fungibility:

Fungibility is the ability of a good or asset to be interchanged with other individual goods or assets of the same type. Fungible assets simplify the exchange and trade processes, as fungibility implies equal value between the assets.

If that still sounds jargon-y, here's a clearer example.

The US Dollar is a fungible asset. So is the Euro, Japanese Yen, and any other government currency. Why? 1 of my US Dollars is always equal to 1 of your US Dollars. They represent equal value.

The key criterium for fungibility is that any one item can be replaced by another item. Some more examples of fungible assets are stocks (1 of my Tesla shares = 1 of your Tesla shares) and commodities (1 of my gold bars = 1 of your gold bars).

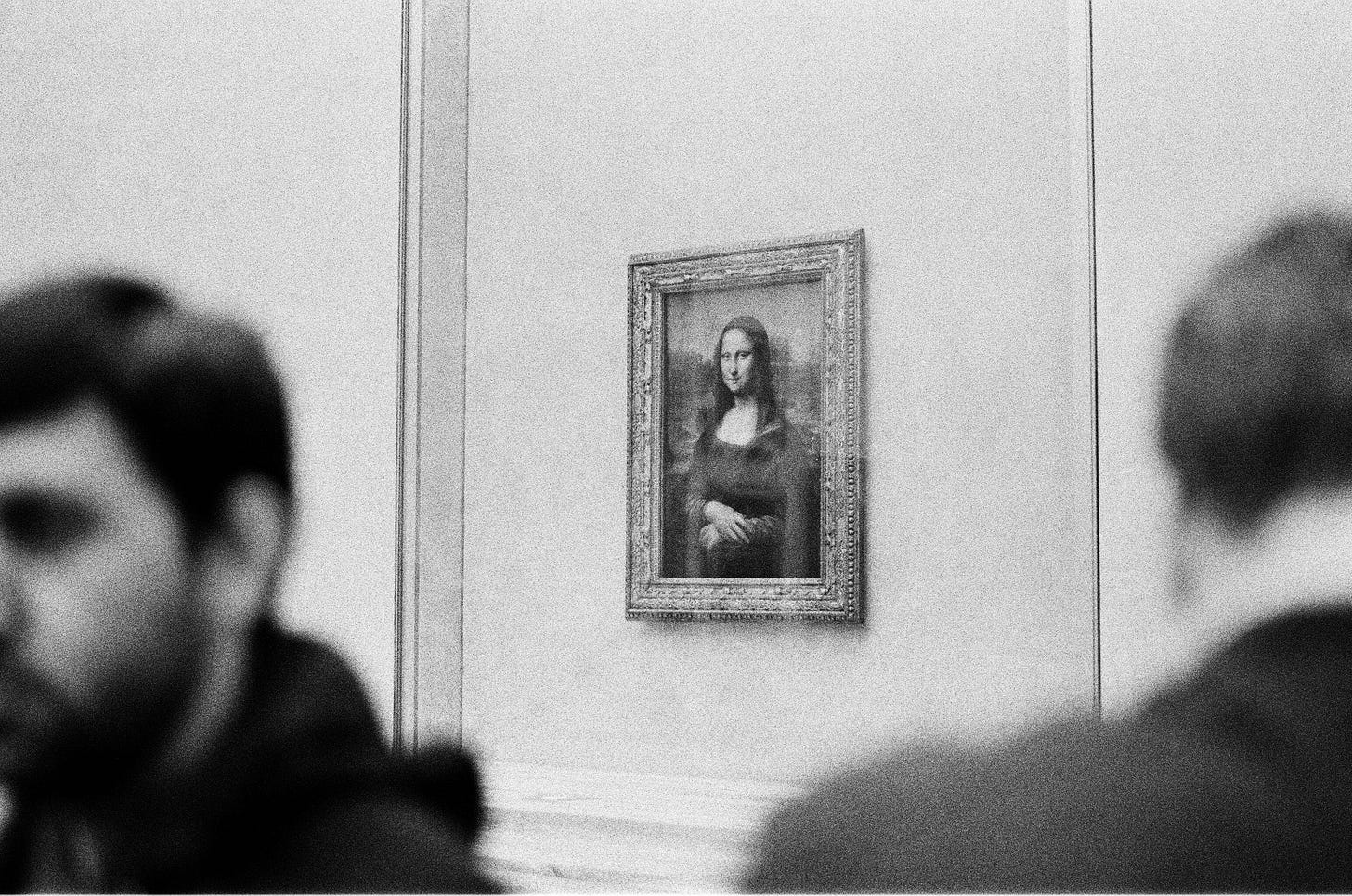

A non-fungible asset, then, is an asset that cannot be interchanged. Non-fungible assets are unique and have nothing else equal to them. A good example of non-fungible assets outside of the crypto world is original paintings. The Mona Lisa is a non-fungible asset; there is only one Mona Lisa and nothing is equal to it.

Tokens

Tokens are built on top of the Ethereum blockchain. At their core, NFTs are smart contracts, just like any other Ethereum token. In order to be able to buy, sell, and transfer NFTs easily, the code within the smart contracts must be standardized across NFTs.

As I discussed in an earlier version of Easy DeFi, most fungible tokens follow a certain standard to make sure that they can interact with many DeFi applications. The standard for fungible tokens is called ERC-20.

Like fungible tokens, non-fungible tokens also follow certain standards. Standards for NFTs are called ERC-721.

Thus, a non-fungible token is a one-of-a-kind asset that lives on the Ethereum blockchain.

How Are NFTs Used Today?

Art

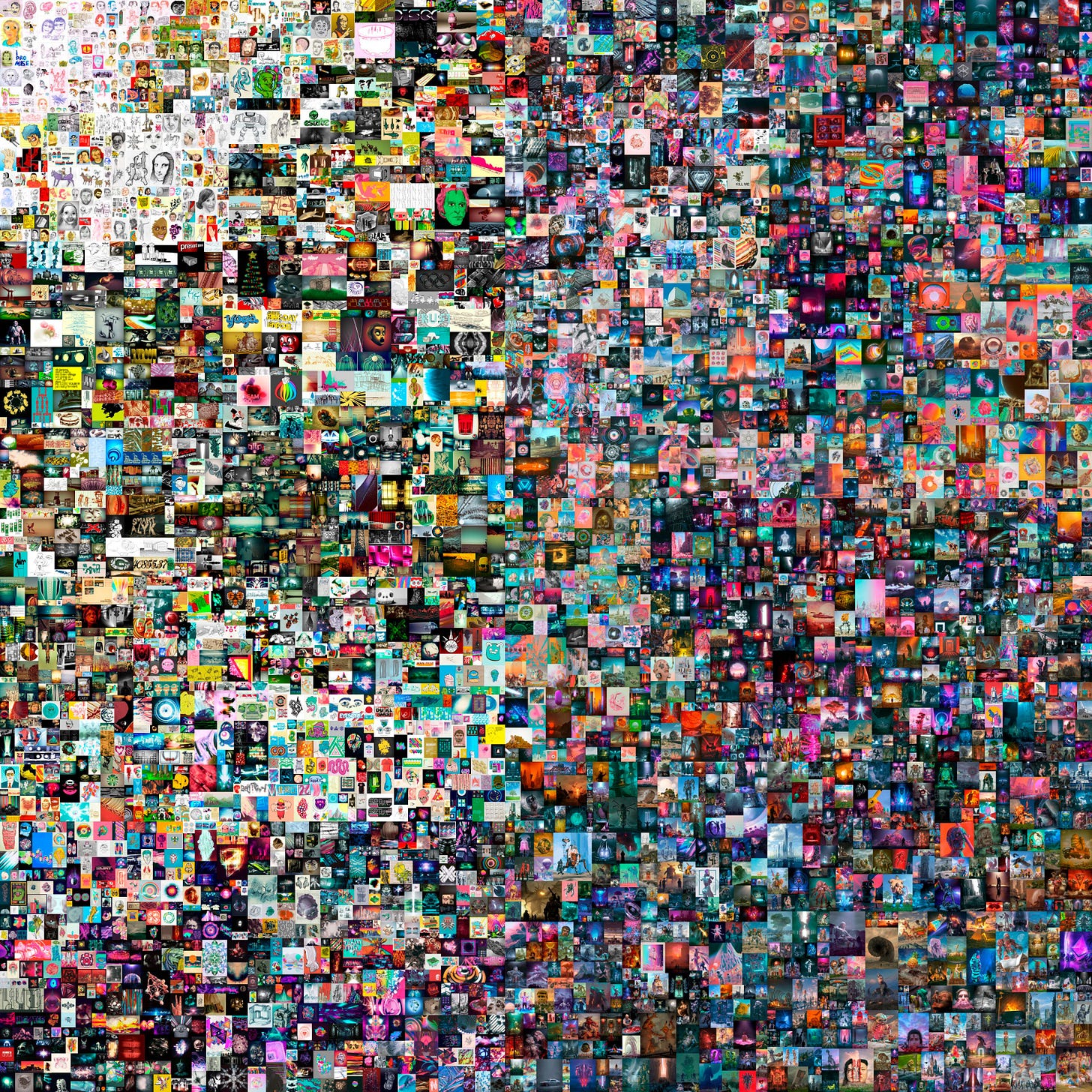

One of the biggest use cases for NFTs today is in digital art. Marketplaces like OpenSea and ZORA allow users to list, buy, and trade NFTs on Ethereum. Everything is done in a decentralized manner, and creators are able to receive the vast majority of the value they create.

Some digital art has fetched astronomical prices. The most expensive NFT in history sold for $69 million through a Christie's auction.

One of the earliest examples of NFTs is CryptoPunks. If you've browsed on crypto Twitter at all, you've probably come across people who have set their profile picture to their crypto punk. Crypto punks some of the most highly sought-after pieces of digital art out there. Since their launch, they've generated total sales of over $480 million. Today, the cheapest punk you can buy is selling for over $49,000.

A common response to the digital art use case is "why would I want to own an NFT when I could look at a picture of the same thing for free?"

While it's true that you could just look at a picture of the NFT, I think we'd all agree that there's something special about owning something. The fact that it's digital makes it tougher to wrap your mind around, but you still do own the piece of art. Further, buying an NFT gives you a closer connection to the creator and helps support their work.

Many claim that the digital art NFT space is a bubble, and I won't speculate on that here, but it's hard to ignore when prices are fetching $69 million.

Games

Another promising use case for NFTs exists with gaming.

Today, one of the top revenue-generating projects on Ethereum is a game called Axie Infinity, which makes use of NFTs as a core part of the game. Players battle characters that are bought and sold as NFTs.

Packy McCormick wrote a fantastic article on Axie which I'd encourage everyone to read. Long story short, Axie could be much more than a game, and NFTs were a critical part of enabling Axie to become what it is today.

DeFi Use Cases for NFTs

The uses above may seem like bubbles or appear irrelevant to the world of DeFi, but that's not the case. NFTs fall perfectly into Chris Dixon's thesis that many great disruptors start out looking like toys.

Uniswap v3's LP NFT

As an automated market maker, Uniswap allows users to pool their tokens to provide liquidity to people that want to buy or sell certain tokens.

When a user does this, they temporarily give up their tokens when they enter the liquidity pool. In exchange for depositing tokens in the pool, Uniswap automatically gives liquidity providers a special NFT.

Not only does this NFT look fancy, but it actually represents real value. The NFT can be redeemed for your position in the liquidity pool as well as any fees that your tokens generated while they were deposited.

Ethereum Name Service

Just like you can buy domain names on GoDaddy or NameCheap, you can buy censorship-resistant Ethereum domains through a service called Ethereum Name Service (https://ens.domains/). Ending in .eth, these addresses are decentralized usernames that you can use to identify your wallet. For example, Vitalik Buterin, the creator of Ethereum, uses vitalik.eth as his wallet ENS.

These ENS names are represented in your wallet as NFTs! They can be transferred and traded just like any other ERC-721 token. Further, no one can stop you from buying a .eth address or take it from your account. You are the full owner!

More Uses for NFTs

NFTs will be much larger than digital art. Digital scarcity and unique assets will be used for numerous financial and social applications in the future, probably in ways that we cannot yet fathom.